As executive recruiters, we often get asked about executive compensation.

So often—after we finish up a search—we aggregate the compensation data we’ve collected across the search, and share it back with the innovation community. In this case, we recently finished a VP Sales search for a profitable SaaS software client located here in the Northeast in November, 2011.

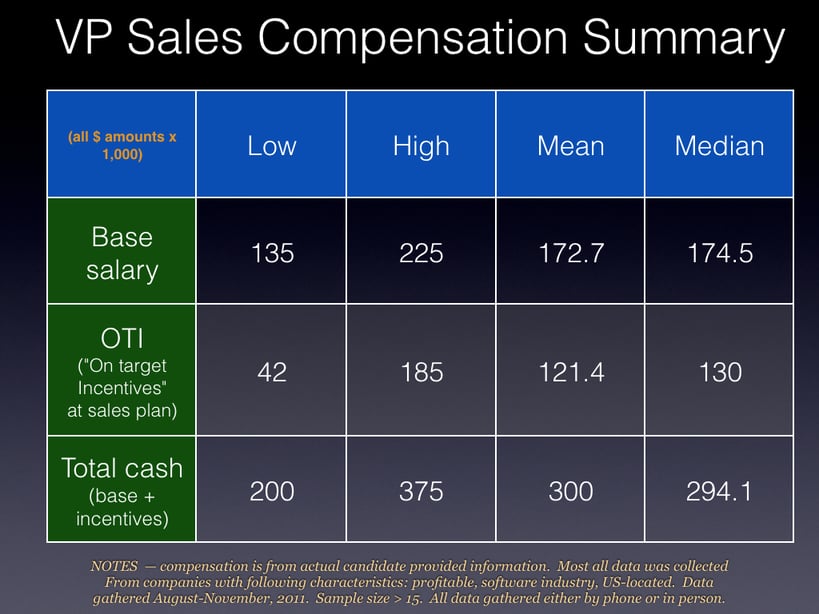

Here is the snapshot of compensation highlights from our search—

The footnote at the bottom of the image above articulates the following criteria for the majority of companies in this data set:

- SaaS software companies (all B2B)

- This compensation data was specifically from those who had at minimum national sales responsibility for the U.S. Regional Sales VPs were not included (i.e., Eastern, Central, or Western Regional VP Sales titles)

- Although a number of these companies had venture capital/external funding, many were also larger publicly traded companies

- Profitable stage

- Companies were located in across the US, with about half located in the Northeast, 25% in the Southeast, and 25% in the Northwest US (Northern CA & WA)

There are many variables to consider that influence where to pinpoint one’s own compensation vis-a-vis the above:

- The more urban locations, the more likely compensation will be higher

- The later the stage of company development, the lower the incentive compensation, the earlier the higher. Yes, this is counter-intuitive, but usually the larger the company, the more mature and capped the incentive compensation plans become

- Note that no equity has been included in this data set of compensation highlights. This does not mean to imply that no equity was held by many of the VP Sales executives surveyed. However, in general, equity is considered less important for the sales team and sales leaders, as their incentive compensation plans serve a similar purpose, simply allowing the sales team and sales leadership to "cash-and-carry" on a quarterly and annual basis more so than the rest of the executive team members who do not share in the same incentive structures and therefore rely on smaller annual bonuses, and typically a larger stakeholder role.